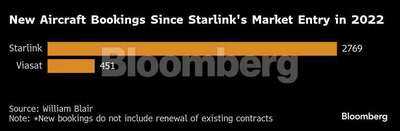

For the past three years, Elon Musk has steadily elbowed his way into the booming market for in-flight Wi-Fi, with his Starlink service signing up blue-chip carriers from Air France to Qatar Airways to United Airlines.

Alaska Air Group Inc. said on Wednesday it will install Starlink starting next year and Virgin Atlantic in early July reached a deal to use the SpaceX-owned satellite network. Arch-rival British Airways might be not far behind, according to people familiar with the matter, in a deal that would let Musk lock up another flagship airline on the lucrative trans-Atlantic route.

But Musk has his eyes on an even bigger prize: the Middle East, home to some of the most trend-setting airlines in the industry and a global connecting hub for long-haul travel.

SpaceX has been in conversation with Emirates, the Dubai-based airline that commands the world’s biggest long-haul fleet of Boeing Co. and Airbus SE aircraft, Bloomberg has reported. Members of Musk’s team have also pitched Starlink to other carriers including Gulf Air and FlyDubai, and are now in advanced talks with Saudia, the region’s No. 3 airline, according to people familiar with the matter.

Winning business with Middle Eastern airlines, particularly those like Emirates recognized for their luxury brands, would mark a watershed moment in Starlink’s global competition against legacy operators like EchoStar Corp., Viasat Inc. and SES SA.

Those rivals aren’t willing to cede ground without a fight. Instead, they are reworking business plans and pursuing a wave of deal-making as the battle accelerates over a fast-growing slice of the $100 billion satellite communications market.

SpaceX has gained a toehold in the global aviation market by delivering the fastest internet connection speeds across the industry using roughly 8,000 satellites. The company offers its Starlink technology through a subscription model in which carriers pay to install the hardware and an additional monthly price for connectivity per seat.

For example, putting Starlink onto a Boeing 737 costs about $300,000, while a larger 787 Dreamliner model commands a $500,00 price tag per aircraft, according to a document seen by Bloomberg. Monthly pricing on a per seat basis can vary based on many factors, including the length of the contract a carrier is willing to sign. But in some cases, Starlink has been agreed to sell its service for around $120 monthly per seat, with an additional $120 for live television, one of the people said.

Negotiations are still underway and carriers could pursue different strategies, the people cautioned. FlyDubai said it’s “currently assessing different options for connectivity to meet our growth plans.” Gulf Air declined to comment. Saudia didn’t reply to requests for comment. Emirates said it’s committed to the best in-flight service, while declining to comment on the deal. British Airways’ parent IAG declined to comment.

In-flight web access was long an offering as exotic as it was unreliable and expensive, both for airlines to install and passengers to use. Many carriers are pushing to provide fast and reliable alternatives, since enabling customer to stream, work and communicate on long flights can be a gamechanger for the cabin experience.

Carriers with an eye for marketing have also bathed in the halo effect of Musk’s star power. Qatar Airways Chief Executive Officer Badr Mohammed Al-Meer was visibly thrilled to be communicating with the SpaceX CEO by video during a Starlink trial at 30,000 feet last October. Starlink internet “is only going to get better,” Musk promised at the time.

Since then, however, Musk’s public standing has shifted from industry disruptor to political iconoclast during his stint as head of the DOGE government-slashing effort under President Donald Trump. That, in turn, has turned off many consumers and has made Musk an increasingly polarizing figure.

With the Trump-Musk relationship now fractured, some countries may hesitate to authorize Starlink and thus associate themselves with the SpaceX boss, particularly those that have closely aligned themselves with the US president.

“There’s a degree of increased sensitivity to all of this political fallout, as seen in things like the falling sales of Tesla cars,” said technology consultant Tim Farrar, an analyst with TMF Associates. “Those airlines might hold back a bit longer.“

Starlink aviation terminals are cheaper than some rival products, according to William Blair & Co. analyst Louie DiPalma, and require less time to install, according to United Airlines.

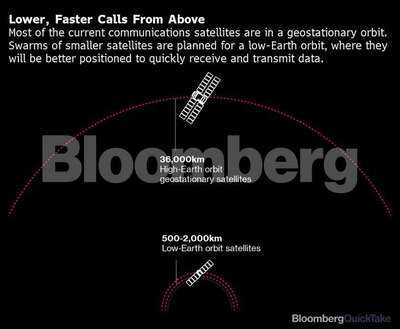

The Starlink network sends signals to an aircraft just as it does to its other 6 million residential, mobile or maritime active users: A terminal about the size of a pizza box is affixed to an aircraft and connects with a stream of satellites moving across its path roughly 350 miles (about 560 kilometers) above Earth, in what’s known as low-Earth orbit, or LEO.

By comparison, legacy operators like Viasat and SES have achieved global coverage with a small number of much larger, more powerful satellites about 65 times higher, in geostationary orbit.

Because these satellites are more distant from Earth, data has a much longer distance to travel, sometimes leading to sluggish internet connection on flights.

But with modern demands for broadband speeds from anywhere, legacy satellite operators are taking a page out of SpaceX’s playbook.

But with modern demands for broadband speeds from anywhere, legacy satellite operators are taking a page out of SpaceX’s playbook.

EchoStar, Viasat and SES have started marketing multi-orbit solutions directly to airlines, pulling together capacity from diversified satellite constellations in geostationary orbits and orbits closer to Earth.

In the past few months, Viasat announced deals to power in-flight connectivity with American Airlines and Riyadh Air. Intelsat, acquired in July by SES, announced partnerships with Thai Airways International and planemaker Embraer.

A multi-orbit system “provides resiliency, it provides consistency, it offers the network operator the ability to adapt to changing environments like weather or a concentration of aircraft around certain parts of the world,” said Andrew Ruszkowski, global head of aviation at SES.

Other large carriers, including Delta Air Lines Inc. and JetBlue Airways Corp., have so far taken a wait-and-see approach on Starlink. Representatives for each declined to comment on discussions with SpaceX.

Their resistance may be explained by SpaceX’s own lingering challenges and restrictions as the company races to build out and improve its network.

SpaceX and airlines have sparred at the negotiating table over Starlink’s demand that carriers offer Wi-Fi free to everyone on board. Starlink has budged on that issue in some cases because airlines have pushed to offer the service only to passengers in their loyalty programs, people familiar with the matter said. Talks are ongoing with other carriers, one of the people said.

SpaceX also requires airlines to agree to install the technology on all of their planes before announcing a deal, the people said, a risky gamble particularly for airlines with larger fleets.

United’s own high-profile bet on Starlink has already hit a snag. In early June, the carrier confirmed it was experiencing issues of static interference with its Starlink system, temporarily shutting off Wi-Fi on two dozen regional planes. United has resolved the issue and installed Starlink on 60 of its regional Embraer planes.

Separately, roughly 60,000 customers reported losing Starlink service in an hours-long outage on July 24. The network suffered another broad but relatively brief outage on August 18.

Starlink is also not authorized in many countries, meaning carriers may have to shut off the internet before landing, aviation executives said. And the service is certain to face competition from networks set to come online in the next couple of years, like Telesat Corp.’s Lightspeed or Amazon.com Inc.’s Project Kuiper, championed by Musk rival Jeff Bezos.

The battle for connected skies is only going to intensify, with unpredictable results. But some executives note Starlink’s data speeds are industry-leading, customers seem impressed and Musk has a track record of upending old-school industries, from rocketry to automaking.

“The overwhelming response is that people can’t get over how fast it is and how they can stream or FaceTime or Zoom,” said Alex Wilcox, CEO of JSX, which provides Starlink-enabled Wi-Fi to passengers on its 30-seat planes. “And so I think they’re going to run away with the market and deservedly so.”

Alaska Air Group Inc. said on Wednesday it will install Starlink starting next year and Virgin Atlantic in early July reached a deal to use the SpaceX-owned satellite network. Arch-rival British Airways might be not far behind, according to people familiar with the matter, in a deal that would let Musk lock up another flagship airline on the lucrative trans-Atlantic route.

But Musk has his eyes on an even bigger prize: the Middle East, home to some of the most trend-setting airlines in the industry and a global connecting hub for long-haul travel.

SpaceX has been in conversation with Emirates, the Dubai-based airline that commands the world’s biggest long-haul fleet of Boeing Co. and Airbus SE aircraft, Bloomberg has reported. Members of Musk’s team have also pitched Starlink to other carriers including Gulf Air and FlyDubai, and are now in advanced talks with Saudia, the region’s No. 3 airline, according to people familiar with the matter.

Winning business with Middle Eastern airlines, particularly those like Emirates recognized for their luxury brands, would mark a watershed moment in Starlink’s global competition against legacy operators like EchoStar Corp., Viasat Inc. and SES SA.

Those rivals aren’t willing to cede ground without a fight. Instead, they are reworking business plans and pursuing a wave of deal-making as the battle accelerates over a fast-growing slice of the $100 billion satellite communications market.

SpaceX has gained a toehold in the global aviation market by delivering the fastest internet connection speeds across the industry using roughly 8,000 satellites. The company offers its Starlink technology through a subscription model in which carriers pay to install the hardware and an additional monthly price for connectivity per seat.

For example, putting Starlink onto a Boeing 737 costs about $300,000, while a larger 787 Dreamliner model commands a $500,00 price tag per aircraft, according to a document seen by Bloomberg. Monthly pricing on a per seat basis can vary based on many factors, including the length of the contract a carrier is willing to sign. But in some cases, Starlink has been agreed to sell its service for around $120 monthly per seat, with an additional $120 for live television, one of the people said.

Negotiations are still underway and carriers could pursue different strategies, the people cautioned. FlyDubai said it’s “currently assessing different options for connectivity to meet our growth plans.” Gulf Air declined to comment. Saudia didn’t reply to requests for comment. Emirates said it’s committed to the best in-flight service, while declining to comment on the deal. British Airways’ parent IAG declined to comment.

In-flight web access was long an offering as exotic as it was unreliable and expensive, both for airlines to install and passengers to use. Many carriers are pushing to provide fast and reliable alternatives, since enabling customer to stream, work and communicate on long flights can be a gamechanger for the cabin experience.

Carriers with an eye for marketing have also bathed in the halo effect of Musk’s star power. Qatar Airways Chief Executive Officer Badr Mohammed Al-Meer was visibly thrilled to be communicating with the SpaceX CEO by video during a Starlink trial at 30,000 feet last October. Starlink internet “is only going to get better,” Musk promised at the time.

Since then, however, Musk’s public standing has shifted from industry disruptor to political iconoclast during his stint as head of the DOGE government-slashing effort under President Donald Trump. That, in turn, has turned off many consumers and has made Musk an increasingly polarizing figure.

With the Trump-Musk relationship now fractured, some countries may hesitate to authorize Starlink and thus associate themselves with the SpaceX boss, particularly those that have closely aligned themselves with the US president.

“There’s a degree of increased sensitivity to all of this political fallout, as seen in things like the falling sales of Tesla cars,” said technology consultant Tim Farrar, an analyst with TMF Associates. “Those airlines might hold back a bit longer.“

Starlink aviation terminals are cheaper than some rival products, according to William Blair & Co. analyst Louie DiPalma, and require less time to install, according to United Airlines.

The Starlink network sends signals to an aircraft just as it does to its other 6 million residential, mobile or maritime active users: A terminal about the size of a pizza box is affixed to an aircraft and connects with a stream of satellites moving across its path roughly 350 miles (about 560 kilometers) above Earth, in what’s known as low-Earth orbit, or LEO.

By comparison, legacy operators like Viasat and SES have achieved global coverage with a small number of much larger, more powerful satellites about 65 times higher, in geostationary orbit.

Because these satellites are more distant from Earth, data has a much longer distance to travel, sometimes leading to sluggish internet connection on flights.

EchoStar, Viasat and SES have started marketing multi-orbit solutions directly to airlines, pulling together capacity from diversified satellite constellations in geostationary orbits and orbits closer to Earth.

In the past few months, Viasat announced deals to power in-flight connectivity with American Airlines and Riyadh Air. Intelsat, acquired in July by SES, announced partnerships with Thai Airways International and planemaker Embraer.

A multi-orbit system “provides resiliency, it provides consistency, it offers the network operator the ability to adapt to changing environments like weather or a concentration of aircraft around certain parts of the world,” said Andrew Ruszkowski, global head of aviation at SES.

Other large carriers, including Delta Air Lines Inc. and JetBlue Airways Corp., have so far taken a wait-and-see approach on Starlink. Representatives for each declined to comment on discussions with SpaceX.

Their resistance may be explained by SpaceX’s own lingering challenges and restrictions as the company races to build out and improve its network.

SpaceX and airlines have sparred at the negotiating table over Starlink’s demand that carriers offer Wi-Fi free to everyone on board. Starlink has budged on that issue in some cases because airlines have pushed to offer the service only to passengers in their loyalty programs, people familiar with the matter said. Talks are ongoing with other carriers, one of the people said.

SpaceX also requires airlines to agree to install the technology on all of their planes before announcing a deal, the people said, a risky gamble particularly for airlines with larger fleets.

United’s own high-profile bet on Starlink has already hit a snag. In early June, the carrier confirmed it was experiencing issues of static interference with its Starlink system, temporarily shutting off Wi-Fi on two dozen regional planes. United has resolved the issue and installed Starlink on 60 of its regional Embraer planes.

Separately, roughly 60,000 customers reported losing Starlink service in an hours-long outage on July 24. The network suffered another broad but relatively brief outage on August 18.

Starlink is also not authorized in many countries, meaning carriers may have to shut off the internet before landing, aviation executives said. And the service is certain to face competition from networks set to come online in the next couple of years, like Telesat Corp.’s Lightspeed or Amazon.com Inc.’s Project Kuiper, championed by Musk rival Jeff Bezos.

The battle for connected skies is only going to intensify, with unpredictable results. But some executives note Starlink’s data speeds are industry-leading, customers seem impressed and Musk has a track record of upending old-school industries, from rocketry to automaking.

“The overwhelming response is that people can’t get over how fast it is and how they can stream or FaceTime or Zoom,” said Alex Wilcox, CEO of JSX, which provides Starlink-enabled Wi-Fi to passengers on its 30-seat planes. “And so I think they’re going to run away with the market and deservedly so.”

You may also like

US warships off Venezuela: Navy vessels head to Caribbean in Donald Trump's push against drug cartels; Maduro deploys 4.5 million militia

How Arsenal pulled off stunning Eberechi Eze deal hijack to embarrass Tottenham

Actress Madhu Shalini is a fighter, says director Shashi Kiran Tikka

Meet the Inspiring Leeza Majhi: From KGBV to Medical College Success!

Why Are Hundreds of Villages in Kandhamal Still Living in Darkness?