The frost is beginning to thaw, and Vedantu has hit the ground running, yet again.

“We aren’t here for a sprint. We’re here for the marathon,” Vamsi Krishna told Inc42, as his beleaguered edtech startup claimed to have broken even with the protracted funding winter on the ebb.

But, is Vedantu’s turnaround a genuine scaling or simply the effect of a lower cost structure? The question is doing the rounds in the Indian edtech landscape.

From being flush with funds to the funds tap running dry – the last five years have seen the edtech sphere running into a rough patch with flagship ventures like Front Row and Udayy shutting shops, giants like BYJU’S and Lido Learning going bankrupt, and scores of smaller potential players like Crejo.Fun and Gonuts either recasting their business models to stay afloat or being gobbled up by their larger peers.

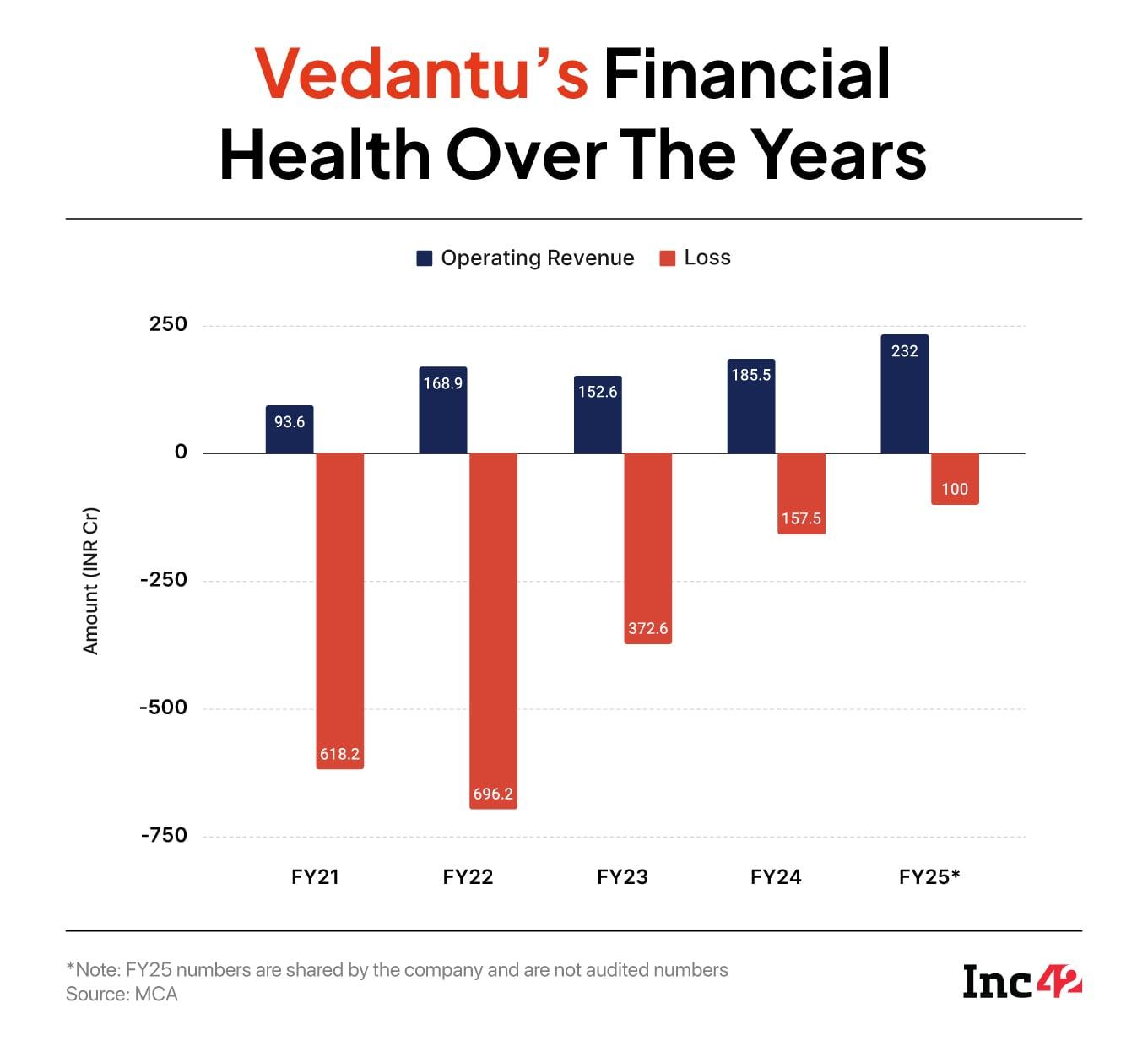

Vedantu, a late-stage startup with over $321.62 Mn funding, grappled with a loss of INR 696.2 Cr in FY22 with cash burn reaching INR 636 Cr on soaring expenses.

As its coffers went scorched, the company tightened the leash on its expenses. A year later, the expenses began plummeting, easing the cash burn to INR 372 Cr, and losses nearly halved to INR 372.6 Cr. The results were more pronounced in FY24 with the losses down to INR 157.5 Cr and the company overturning the situation by generating INR 104 Cr more cash than its expenses.

By the end of FY25, Vedantu turned profitable with INR 6 Cr in free cash flow. “The Q4 of FY25 was our strongest quarter ever. We hit INR 90 Cr in collections – a 67% YoY growth – and became profitable, generating more than INR 6 Cr in FCF, and this wasn’t even our peak quarter, which puts us on a clear trajectory to go cash flow positive in FY26,” Krishna wrote in a LinkedIn post.

The turnaround has put Vedantu on the IPO track. “It wasn’t an easy task to revive from an industry-wide downturn,” Krishna said.

“We learned from the mistakes we made when we were at our peak,” said Vamsi Krishna, who had built Vedantu with Anand Prakash and Pulkit Jain and named it as the ‘web of leanings’.

The 2014-born startup saw demand soaring when the planet reeled under the pandemic and everything came to a screeching halt. As schools went shut and stepping out of homes was barred, more and more students turned to the online mode of learning.

Looking at an increasing active user base, Vedantu went full throttle to raise more than $200 Mn. But the party was short-lived. With the COVID waves receding, life limped back to normalcy. As schools reopened, edtech began losing the sheen. And, then came the geopolitical blow with the Russian invasion of Ukraine driving investors in a tizzy. Cracks surfaced in the two main pillars of the edtech industry – online learning and scaling with external funds.

“The leaks stared us in the face. As COVID began, we overhired. As we kept growing 12 times on-year, we hired more, until we realised around mid-2022 that this wasn’t sustainable. We were forced to lay off,” Krishna said. From over 3,500 employees in its prime, Vedantu lowered the headcount to below 1,000 at the end of FY23.

This helped it cut down on employee cost from INR 489 Cr in FY22 to INR 313.5 Cr a year later and to INR 175.8 Cr in FY24.

As new normal became the norm, offline learning regained its momentum. “In the middle of 2022, when the whole edtech industry was sailing through a violent storm, we encountered an existential question: Is the edtech sector still there?” Krishna said.

The COVID pandemic caused major disruption in lives as well as in businesses across the world. The average Indian parents were more focussed on their children’s education after the dropout rates more than tripled – from 1.8% in 2018 to a staggering 5.3% in 2020 – and the education quality went sharply downhill.

“All we had to do was hit a pause and listen to what the students wanted. They wanted offline learning. So who are we to stop it?”

This is when Vedantu pivoted to hybrid learning. It launched two hybrid experimental centres in Bihar and Tamil Nadu, seeing a massive headroom for growth, but this time desisted from scaling like its peers. While BYJU’S rolled out BYJU’S Tuition Centre, Unacademy floated Unacademy Centres to enter the offline space.

“Instead of burning crores in setting up offline centres, we opted for inorganic growth by acquiring Deeksha for $40 Mn in 2022,” Krishna said.

Then Came The Focus On GrowthDeeksha, which primarily operated in Karnataka, was profitable when Vedantu took it over in 2022. While Deeksha Vedantu, as it was rechristened after the acquisition, helps in preparation for competitive exams for students of Classes 11 and 12, Vedantu offers courses for students from the 4th to 12th standards. It also provides coaching for NEET and JEE entrance examinations. It has recently started offering curated courses for kids of 4 to 12 years of age.

Deeksha today operates across 40 centres in collaboration with schools, offering tuition to 20,000 students across Karnataka and some South Indian states. Vedantu, on the other hand, runs 35 learning centres across the country, serving 1,50,000 students.

The offline foray has helped Vedantu maintain its operating revenue – from INR 168.9 Cr in FY22 to INR 152.5 Cr a year later and then to INR 184.5 Cr in FY24. According to the company estimates, its topline reached INR 232 Cr in FY25.

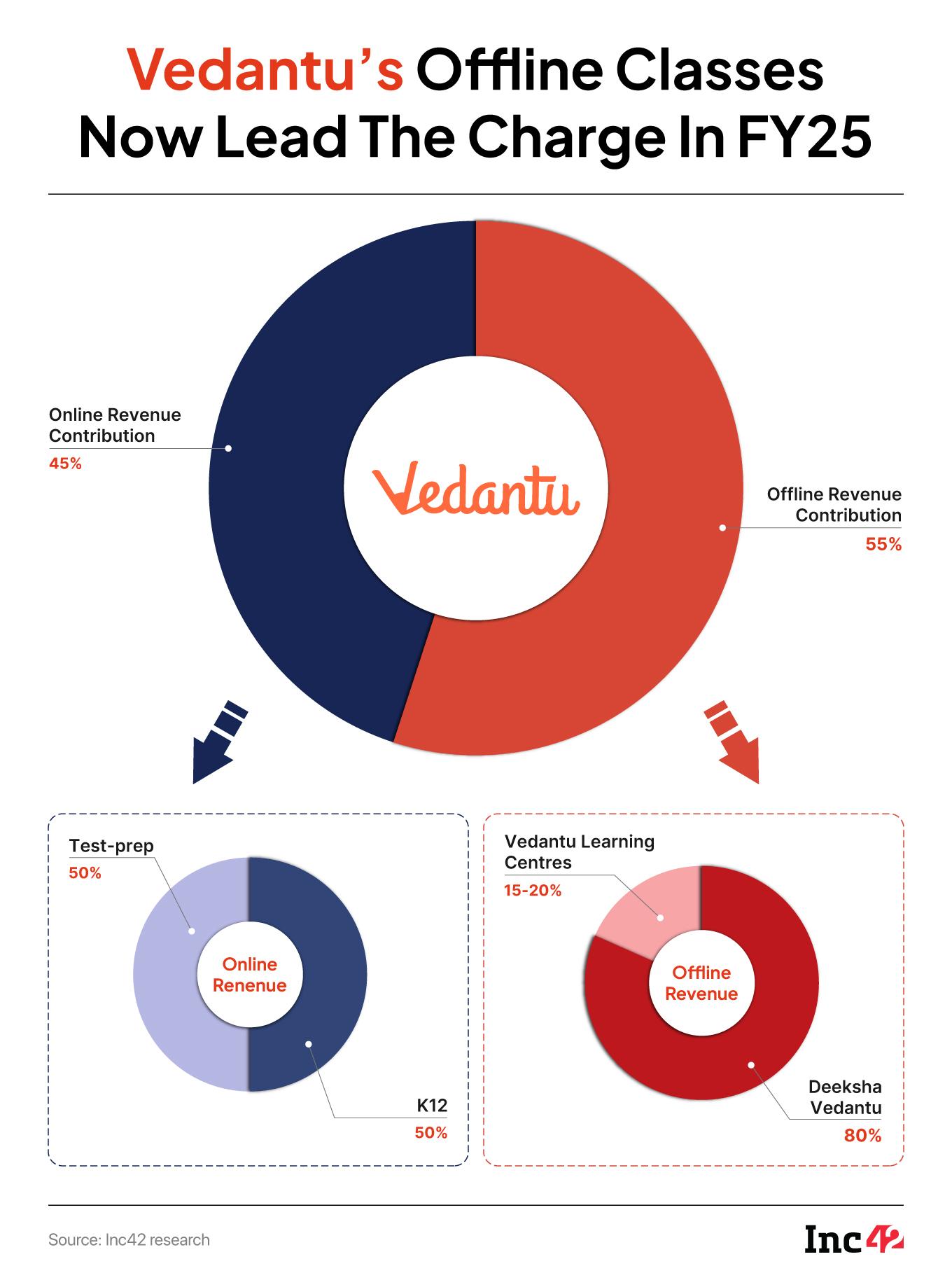

“Almost 55%-60% of our revenue came from our offline centres in FY25, with 70% of the centres achieving break-even in the first operational year itself,” claimed the founder.

The collapse of edtech giant BYJU’s and Unacademy’s scale-back have veered traffic to Vedantu over the last two years.

While the hybrid business model helped Vedantu retain its topline momentum, the startup kept on tightening the noose around its expenses to beef up the bottomline. After reducing the fixed cost, which was primarily employee cost, the other expenses like sales and marketing costs and the teacher delivery costs were lowered. Over the course of the last couple of years, Vedantu brought down its total expenses by 34% to INR 367.8 Cr in FY24 from INR 553 Cr a year back.

“We can’t scale when the contribution margin is negative, it will only widen the loss. As we arrested this, we hit the growth pedal in FY24,” Krishna said. The startup’s advertising and employee benefit expenses combined dropped 70.5% to INR 198.6 Cr in FY24 from INR 671 Cr in FY22.

Vedantu has just surpassed the COVID peak in terms of revenue with the topline reaching INR 185 Cr in FY24 as against INR 169 Cr in FY22, following massive cost control exercises. This raises question whether the company has genuinely scaled or is simply surviving on a leaner cost structure.

Rival Unacademy remains larger in terms of revenue, but continues to struggle with deep structural challenges. In FY24, both its revenue and expenses contracted, as its key bets Graphy and Relevel underperformed. With cofounders Gaurav Munjal and Roman Saini exiting the company to focus on hived-off AirLearn, Unacademy seems to have reached a tight spot.

PhysicsWallah (PW), which has been on an aggressive expansion mode with an IPO on the horizon, will be faced with the challenge of rationalising operations, shutting underperforming bets, and reducing fixed costs to restore financial discipline, without losing the momentum on growth.

Krishna said that for two quarters – January to March of FY25 and April to June of FY26 – Vedantu has been cash flow positive. While it is true that Vedantu is still a smaller entity compared to a PhysicsWallah or an Unacademy, the company hopes to add INR 100 Cr more to the topline in FY26.

“Cost was a challenge, we resolved it. Growth was another challenge. We’re on course to resolve that too. Now it is time to hit the pedal again to scale,” Krishna said.

Vedantu is now focussed on hitting the securities market in the next two years. The company plans to list its shares once it hits a revenue run rate of INR 800 Cr. According to the founder, it hopes to raise $70 Mn to $100 Mn from the IPO.

The startup claimed to have managed to claw its way back to growth, but the road ahead requires cautious navigation. The edtech firm’s pivot from a purely online model to a hybrid model helps it to stay relevant through an industry-wide shakeout, but the capex-heavy expansion goes against its major cost-cutting drive.

Setting up and scaling physical centres call for consistent capital flow, disciplined execution, and tighter cost controls. This is in stark contrast to the company’s strategy to keep off any major primary infusion before its IPO. The startup plans a secondary offering to its foreign investors to exit.

Again, with a listing on the cards, Vedantu needs to be selective while laying out the expansion blueprint, doubling down on high-performing centres, and possibly shutting down or consolidating underperforming verticals.

With a relatively thinner topline, compared to Unacademy or PhysicsWallah, Vedantu’s challenge lies in scaling sustainability without slipping back into its cash-burn mode.

Edited By Kumar Chatterjee

The post From Burn To Break-Even: Vedantu Plugged Leaks But Will The Revival Last? appeared first on Inc42 Media.

You may also like

Rate of disposal of consumer cases fell in 2024 and 2025 as vacancies in commissions rise

Golden opportunity for youth! Recruitment of Assistant Agriculture Engineer in Rajasthan

Palghar Crime: Virar Police Bust ₹11 Lakh Camera Gear Theft, Arrest 2 Accused From Navi Mumbai

'Sampoornata Abhiyan' awards honour Gujarat's top-performing districts and blocks

Bengal: Couple arrested for cyber fraud with 900 FIRs registered against them