Jio Financial Services (JFS) has been a looming threat for fintech startups from the moment it emerged on the scene. The might of Reliance’s network, capital and its data prowess gave JFS a sizable advantage over the field even before things had begun.

It’s this advantage that has allowed JFS to take its sweet time, place the building blocks without much hurry and get ready for the full onslaught. By all indications, there’s little holding the platform back now.

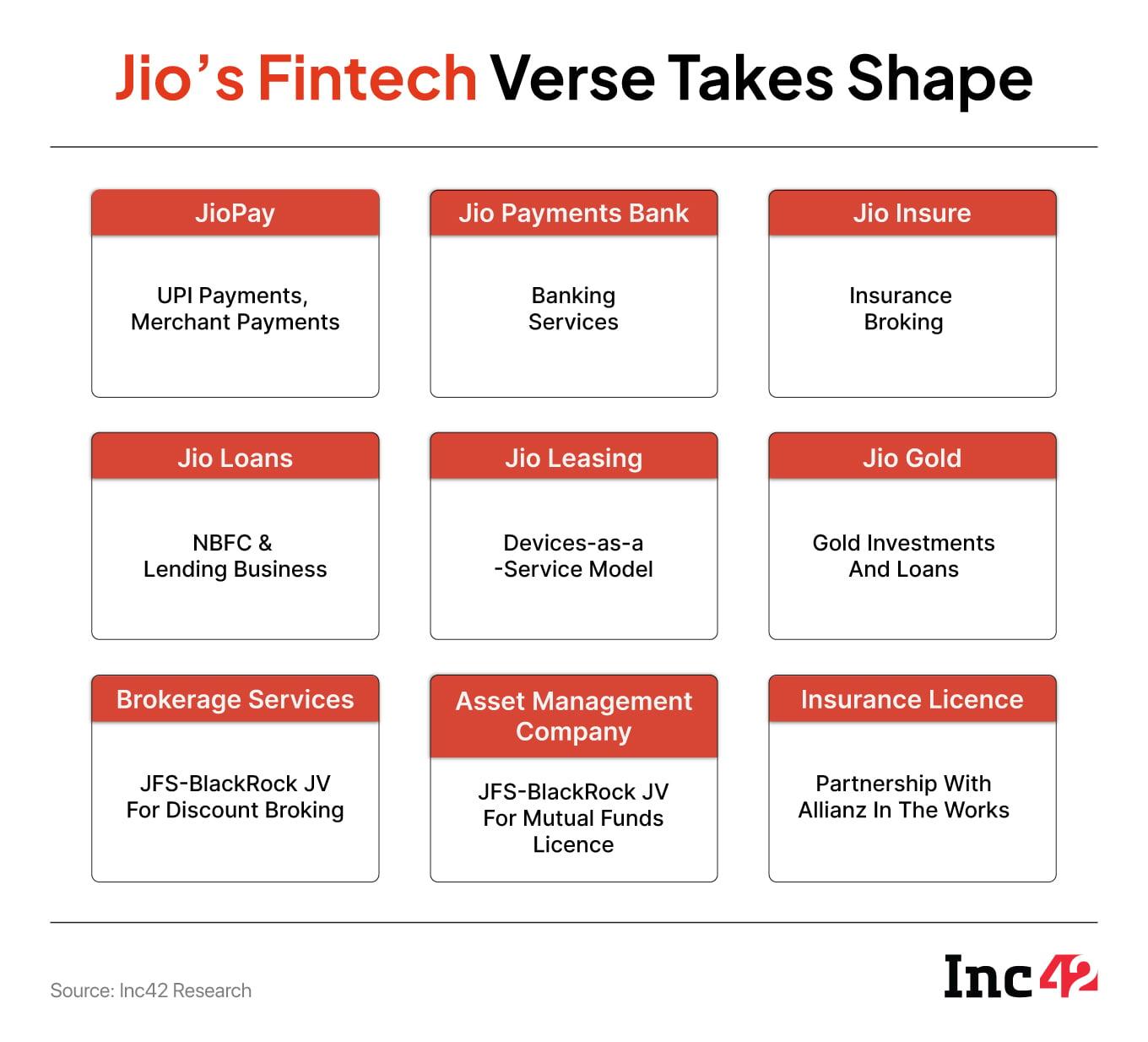

This week, the JFS-BlackRock JV got the SEBI nod to launch discount broking services, putting JFS in the league against Zerodha, IPO-bound Groww, AngelOne and others. Along with its AMC licence, this is JFS bringing its full might to the battle.

Let’s dive in, but first a look at the top stories from our newsroom this week:

- Fighting Fake News: Karnataka’s draft bill proposes jail terms of up to seven years and hefty fines for spreading fake news or misinformation online, but is this taking too broad a stance on the issue and will digital media startups end up paying the price?

- Urban Company’s Makeover:Just as Urban Company is getting ready to list on the public bourses, it is also undergoing a massive shift from a services-first model to a wider consumer durables play

- Amazon’s Boogeyman: Amazon’s fourth attempt at quick commerce foray comes out of compulsion, and not just trend hopping as the retailer is losing market share to younger incumbents. Will Amazon Now succeed where previous efforts failed?

Even though Zerodha cofounder and CEO Nithin Kamath tried to downplay Jio’s entry, it’s hard to see how JFS does not eat into Zerodha and Groww’s revenue, which have seen some growth challenges in the past year.

JFS’ entry into the stockbroking space doesn’t pose as much threat to Zerodha as first-time founders, claimed Kamath. “I still feel our real competition is going to be more from first-generation founders who are running, breathing, and always thinking about broking. I somehow don’t feel it (the competition) is really going to be from incumbents,” he said in an X post.

Kamath believes that Jio “probably” has the “distribution might” to further expand the participation in Indian retail investor market beyond the current audience. “We’re largely limited to the top 10 Cr Indians. If anyone can expand the markets beyond the top 10 Cr Indians, it’s probably Jio with all its distribution might,” the CEO said.

One can argue that this is a self-serving statement, but Zerodha is not known to raise alarm bells in the face of new competition. Even MobiKwik received the green light this week to jump into the melee — there was no statement from Kamath on this entry. One could say that JFS has indeed sparked off some intense conversations in the broking industry, as Kamath himself indicated.

Zerodha is one of the leading players in the Indian stock broking space. It reportedINR 5,496.3 Cr in profit for FY24 with revenue at INR 9,372.1 Cr. Groww has more active investors but its revenue trails Zerodha. Groww’s revenue scaled to INR 3,145 Cr in FY24 and its EBITDA also improved to INR 535 Cr, though it reported a net loss as a result of redomiciling to India from the US.

Zerodha and Groww have both also made inroads into the AMC business, where Jio will once again be a threat thanks to its JV with BlackRock and an initial $300 Mn investment.

A Lending Giant In The MakingBut investment tech is just one part of JFS’ plan. The company has modelled itself after Paytm, PhonePe, CRED and others with the super app strategy. Jio Financial Services manages the operations at the consolidated level, but there are a number of subsidiaries — some mandated by regulations — handling the verticals.

In Q4 FY25, Jio Financial Services (JFS) posted a consolidated net profit of INR 316.11 Cr, marking a modest 1.7% increase year-on-year from INR 310.63 Cr in Q4 FY24. This is largely on the back of the company’s early lending business and revenue from before the demerger from Reliance Industries.

Operational revenue for the quarter was INR 493 Cr, but the real story was evident in the company’s rapid on-ground expansion and vertical diversification.

The company’s NBFC arm, Jio Finance Ltd, continued to fire on all cylinders. Assets Under Management (AUM) soared to INR 10,053 Cr by March 2025, a staggering leap from ₹173 crore a year earlier. This momentum was driven by rising demand for lending, supply chain finance, and digital-first consumer credit—offered via Reliance’s expanding ecosystem of telecom and retail touchpoints.

On the banking side, Jio Payments Bank saw a threefold rise in its customer base to 2.31 Mn users. Customer deposits and wallet balances stood at INR 295 Cr—also a 3x year-on-year jump—while the platform processed over 4.08 Mn UPI transactions worth INR 318 Cr in March 2025 alone, placing it among the top 30 UPI apps in India. The rollout of JioSoundPay, a voice-based UPI interface for feature phone users, signaled a clear push toward mass-market financial inclusion.

In insurance, Jio’s broking vertical onboarded 34 insurance partners and launched 61 digital-first, do-it-yourself products. Meanwhile, its payments subsidiary secured a payment aggregator license, further embedding itself into the fast-growing merchant payments ecosystem. The company is close to acquiring an insurance licence as well which would allow it to collect premia directly from consumers and businesses.

Even if Zerodha’s Kamath believes investment and discount broking is just for the “top 10 Cr Indians”, JFS is looking well beyond that.

JFS’ Dilemma: Scale Vs Network EffectThat’s not to say that incumbents don’t have any advantage in this battle. Protecting their existing revenue is certainly a big incentive, but even incumbents have some inherent competitive edge in this fight against JFS.

Sharat Chandra, founder of EmpowerEdge Ventures, believes that building a super app is not only about scale or user base. “I’d still say PhonePe has a much more robust and evolved ecosystem than what Jio is aspiring to build.”

He cautioned that Jio’s deep pockets don’t yet amount to a cohesive offering that can disrupt entrenched players. A seamless, cross-vertical experience is still missing, Chandra believes, which could be something that Jio would look to fix.

Indeed, other players have attempted similar aggregation. The so-called ABCD model—acquisition, banking, credit, and data—is easy to outline on slides but historically hard to deliver. Chandra says that Jio is late to the party. PhonePe, Paytm, and Google Pay already command deep integration, user stickiness, and behavioral patterns bred over years. For JFS, catch-up is a long game.

What about the distribution advantage for Jio? A telecom subscriber base exceeding 500 Mn, coupled with 15,000+ Reliance Retail outlets, allows cross-offers on telecom recharges, groceries, electronics purchases, and financial products.

This has brought deep consumer trust and brand familiarity, and gives Jio a runway most startups dream of. But personalisation is also a differentiator. Here Jio has the data advantage too for hyperlocal, data-driven personalisation.

What’s Jio’s Real Leverage?Founder of a fintech focussed VC firm said that Jio’s arrival shouldn’t be seen as a knock-out blow to incumbents. “Financial services are not a winner‑takes‑all market. HDFC Bank, for instance, still has only single‑digit market share.”

The biggest challenge could well be the tech behind the super app. For many, JFS still lacks a cohesive user experience — its financial products feel scattered across platforms, unlike PhonePe or Paytm, which offer seamless user journeys and others such as CRED which differentiate on design.

Margins pose another issue. Unlike telecom, where Reliance Jio thrived on scale and undercut pricing, financial services demand caution. Low rate loans may bring in users, but also risk higher defaults.

Similarly, zero-load mutual funds sound consumer-friendly but generate razor-thin profits unless the AUM grows massively. These are questions for JFS to answer in the next few months as its service base grows.

As Kamath or others say, Jio has the big guns and the deep pockets, but this is not a guarantee for winning in the fintech game.

Sunday Roundup: Startup Funding, Acquisitions, Disputes & More

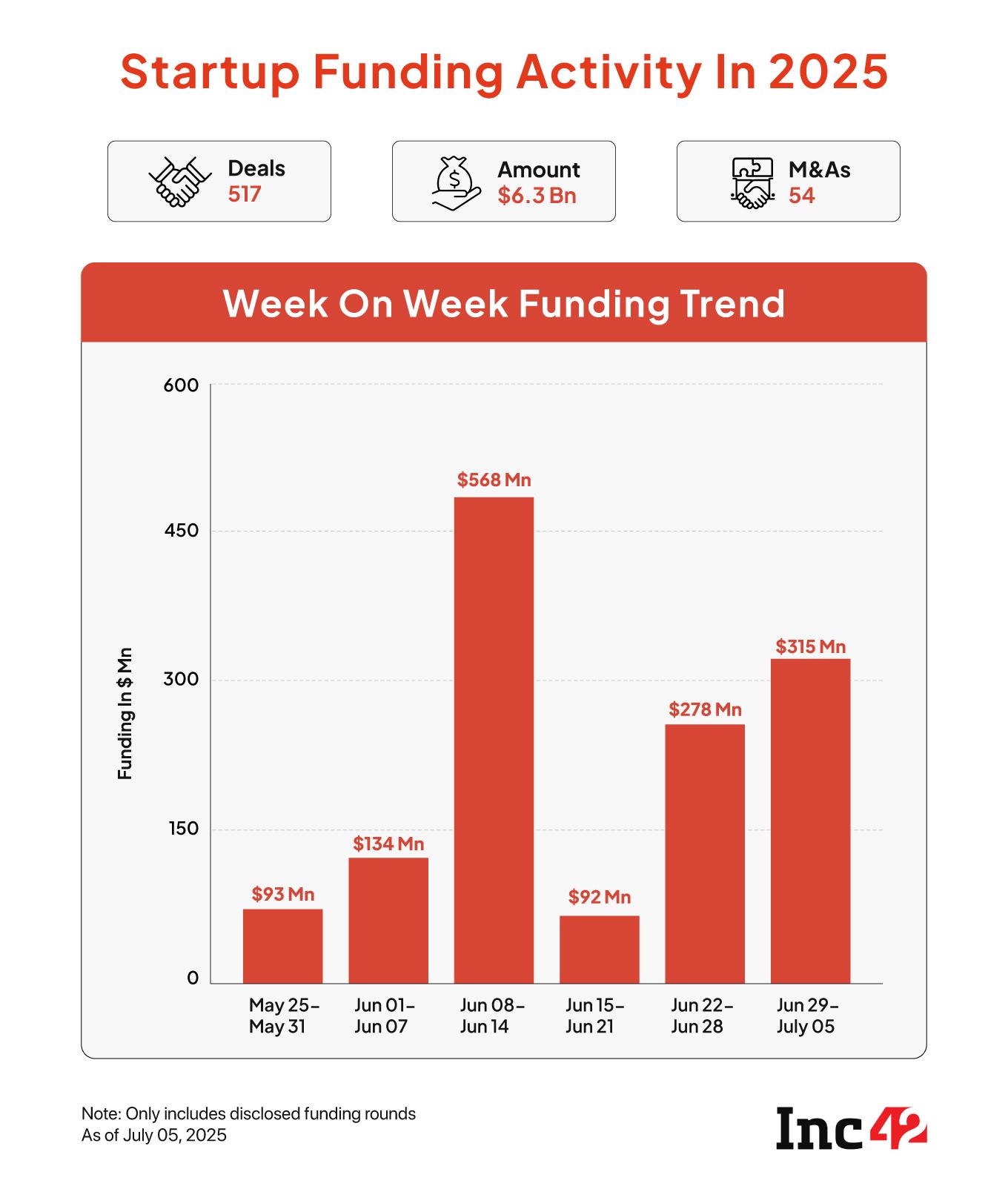

- New Unicorn In Town: India got its 124th unicorn in the form of Jumbotail, as a total of $315 Mn was raised by Indian startups between June 30 and July 5

- Zomato Vs NRAI: Irked with the foodtech’s newly introduced long-distance service fee, the industry body plans to hold a meeting with Eternal founder and CEO Deepinder Goyal to resolve the issue. The new fee breaches Zomato’s cap on commission of 30% to 35%

- Zoho Bets on Robotics Again: The SaaS giant has acquired Asimov Robotics in an undisclosed deal to expand its R&D capabilities in the robotics space. This is Zoho’s second investment in the space as it earlier acquired stakes worth INR 20 Cr in Genrobotics

- UPI Takes A Hit In June: The digital payment infrastructure clocked 18.40 transactions in June, down 1.5% from 18.68 Bn in the previous month. The value of transactions also declined 4.4% month-on-month to INR 24.04 Lakh Cr last month

The post Has Jio Financial Services Rattled Fintech Giants? appeared first on Inc42 Media.

You may also like

Keir Starmer must slap wealth tax on richest Brits, warns ex-Labour leader Neil Kinnock

FairPoint: After Pahalgam attack, Amarnath Yatra emerges as a march of faith and resistance

Arsenal sign Martin Zubimendi and pay MORE than release clause after frustrating transfer delay

Joao Felix sends pointed transfer message as biggest Chelsea hint yet dropped

'Great danger to democracy': Mahua Moitra moves SC over EC's voter list revision in Bihar; calls it 'crazy exercise to disenfranchise'