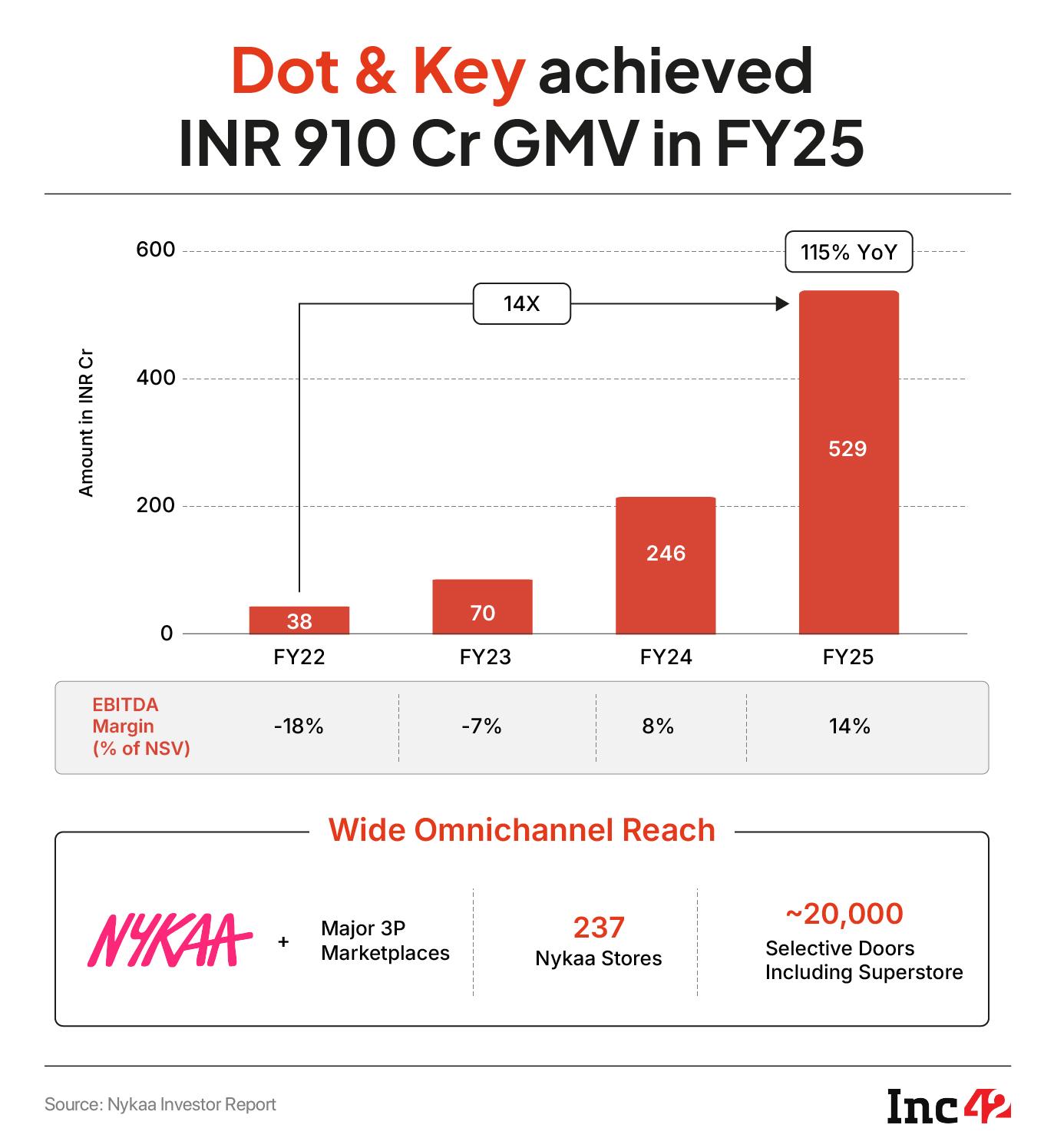

As India’s beauty and personal care (BPC) market marches towards a $28Bn market opportunity by 2030, skincare brand Dot & Key has posted a gross merchandise value (GMV) of INR 910 Cr for the financial year 2024-25 (FY25).

Its net sales value (NSV), which is revenues after deducting sales returns, allowances, and discounts from its gross sales, soared from INR 246 Cr in FY24 to INR 529 Cr in FY25, up 115% year-on-year (YoY).

The growth of Dot & Key, founded by Suyash Saraf and Anisha Agarwal Saraf in 2018 after the duo identified crucial gaps in the Indian skincare market, has been fuelled by its rigorous R&D process focused on clean formulations and ingredient transparency, which has resonated strongly with millennial and Gen Z consumers.

The brand, which offers a range of products, including moisturisers, sunscreen, lip balms and targeted serums for specific skin concerns like hyperpigmentation, dullness and barrier repair, improved its EBITDA margins, which stood at 14% in FY25. The brand reported this metric at -18% in FY22.

But, what has been behind Dot & Key’s rare blend of rapid scale and profitability in an ecosystem marred by heavy burn rates?

As per founders, the brand has been able to emit such radiance, helped by its commitment to walk the talk in a sector that is filled to the brim with lofty promises, false claims and pseudoscience.

The brand is steadfast on solving problems over chasing trends. This has helped the brand scale for four years, until 2021, without external funding and with just INR 1 Cr in hand.

Speaking with Inc42, the founders said that their vision has always been to save the market from impostors — the brands that promise to offer ‘natural’, ‘ayurveda’ or ‘chemical-based’ solutions but “don’t walk the talk”.

“This leaves consumers in a limbo of confusion and with trust issues. Dot & Key fills this gap,” Saraf, whose tryst with many brands has not been worth remembering, said.

Staying committed to their vision of delivering clean, chemical-free, natural skincare products, the founders soon expanded to over 20,000 retail stores and 237 Nykaa stores, making its SKUs widely available across India.

Dot & Key’s journey began with limited reach and a fair share of industry scepticism.

“Scaling was slow at first due to reasons related to trusting a new entrant,” Saraf said. This made the founders focus on customer feedback and retention rather than chasing rapid growth by burning cash. In its formative years, Dot & Key relied entirely on organic growth without external capital.

The founders built their reputation methodically through repeat purchases, word-of-mouth referrals, and strategic product innovation.

By 2021, Dot & Key had created sufficient market momentum to attract strategic partnerships. Their collaboration with Nykaa that year accelerated their already established growth trajectory. Building on their solid foundation, the brand experienced remarkable expansion, achieving profitability by January 2023—a dramatic turnaround from losses just a year prior.

This became a pivotal milestone for the founders, who now had one thing in mind — to make the brand synonymous with quality, innovation and speed.

This demanded an in-house R&D team, which the founders set up in 2023. The R&D team helped the brand enable faster testing, real-time feedback integration, and build a portfolio of intellectual properties.

The R&D team also came up with playful-yet-premium pastel packaging, and a joyful design quickly made it recognisable and relatable in an industry crowded with lookalike bottles.

But beyond its appealing aesthetics, Dot & Key embedded consumer feedback directly into its R&D process, ensuring each product met the real needs of its customers in terms of texture, efficacy and overall experience.

In the Indian BPC space, it locks horns with brands like Plum and Minimalist. When it comes to distribution, Dot & Key has a strong omnichannel presence. Approximately 70% of its sales come from major ecommerce platforms, 20% from its website and 10% from offline channels.

Scaling With Omnichannel StrategyDot & Key’s strength, as per the founders, lies in building from insight rather than imitation. “Every product is designed to solve genuine and under-addressed problems.”

When Dot & Key entered the market in 2018, India’s skincare space was young and shaped mainly by traditional standards. Innovation was limited.

Initially, the brand’s playful, ingredient-led and problem-solving approach resonated with young millennials, but Dot & Key has now pivoted to reposition itself to connect with GenZ consumers as well.

This adaptive strategy seemed to have paid off, as shown in its upbeat FY25 results.

What has helped is Dot & Key’s expansion of product lines, improving repeat rates and a strong omnichannel presence.

“Our EBITDA margins have improved sharply from -18% in FY22 to 14% in FY25. The metric stood at -7% in FY23 and 8% in FY24,” Saraf said.

To fuel this momentum, Dot & Key invested in building a sharp, attention-grabbing marketing engine that combined creator-led content with native platform campaigns.

Moving with the times, the brand has also started to use AI to deliver more personalised skincare journeys and smarter consumer experiences, making product discovery and usage as intuitive as the formulas themselves.

As India’s BPC market booms and online channels lead with an expected growth rate of 25% between 2023 and 2028, skincare alone is projected to grow at a CAGR of 13%. Fuelling this growth is India’s rising disposable incomes, broader ecommerce access and a growing preference for premium products.

In the country’s tough BPC space, where many new brands struggle to achieve both scale and profitability and perish before making a name, Dot & Key has achieved significant revenue growth and profitability.

However, competition is on the prowl, with players like Mamaearth, Minimalist, The Derma Co, Foxtale, Plum, mCaffeine, too, vying for a juicy slice of the market, and each has a unique customer acquisition playbook. This raises but one question — can Dot & Key sustain its growth momentum?

The post How Dot & Key Scaled To INR 529 Cr & Minted Profits In A Hyper-Competitive Skincare Market appeared first on Inc42 Media.

You may also like

PM Modi to visit Assam on September 13, 14

Tourists 'dine and dash' at Italian restaurant but owner gets instant revenge

'My selfish friend treated me like a chauffeur so I left her stranded - I have no regrets'

Minneapolis shooting LIVE: Gunman storms into school and shoots 20 people

Nepal appreciates Delhi Police for saving innocent Nepalis from visa fraud racket