With US president Donald Trump announcing tariffs on imports from almost all countries, the global equities market saw trillions of dollars of wealth being wiped out this week. In line with this, the Indian stock markets crashed over 2.5%.

However, it wasn’t an outright gloomy week for new-age tech stocks under Inc42’s coverage. In the first week of April, 16 out of the 32-new age tech stocks gained in a range of 0.21% to a little over 18%.

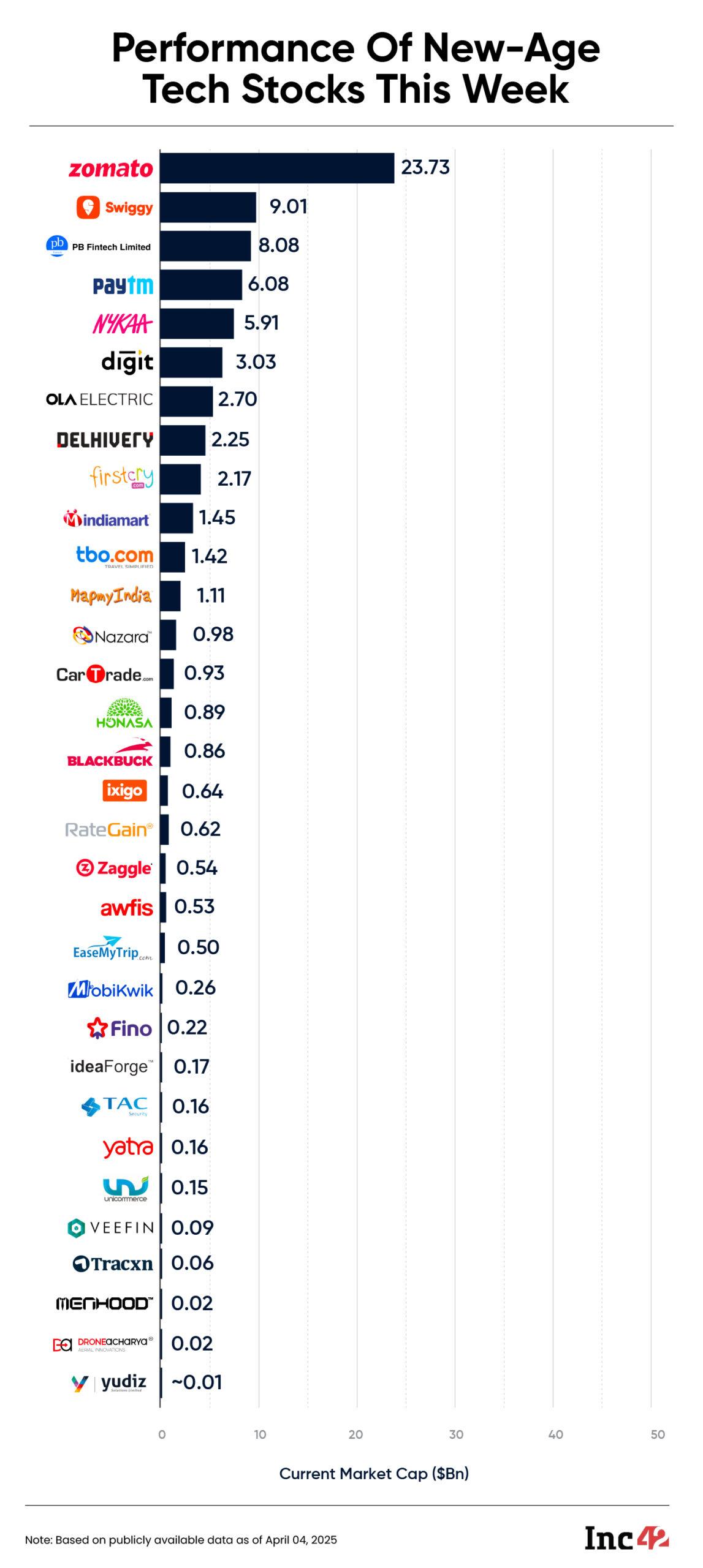

Besides, the overall market cap of the new-age tech companies stood at stood at $74.75 Bn at the end of the week, slightly up from last week’s $74.07 Bn.

Veefin Solutions, the biggest loser last week, emerged as the top gainer this week. The stock rose 18.07% to INR 317.25. The company’s shares tanked to a fresh 52-week low of INR 256.10 during the intraday trading on Tuesday (April 1).

The bull run for Veefin came after it announced that it has onboarded public sector banks Bank of Baroda, Central Bank of India, Indian Overseas Bank, and UCO Bank as customers for its supply chain finance platform PSBXchange by PSB Alliance.

Other gainers this week included, Zomato, Unicommerce, Yudiz, EaseMyTrip, Swiggy, among others.

Among the list of gainers, fintech major Paytm saw its shares zoom 4.19% to end the week at INR 816.35. With this, the company’s market cap crossed the $6 Bn mark and ended the week at $6.01 Bn.

The Vijay Shekhar Sharma-led company saw multiple business developments. After informing the bourses last week that it had sold its , this week saw Paytm partner with Greater Hyderabad Municipal Corporation to deploy more than 400 Paytm innovative All-In-One EDC Devices (card machines) for tax collection.

On Friday (April 4), the company unveiled a new soundbox, , with added features like real-time payment updates on a display screen and a clear overview of daily transactions.

Meanwhile, shares of MobiKwik ended the week 6.89% lower at INR 283.85. The stock closed the week 36% lower from its listing price of INR 442.25.

MobiKwik was among the 16 new-age tech stocks which fell in a range of 0.07% to under 8% this week. TBO Tek was the biggest loser this week, with its shares sliding 7.42% to end at INR 1,115.75. The company’s shares touched an all-time low of INR 1,105.05 during intraday trading on Friday.

Other losers this week included Zaggle, PB Fintech, BlackBuck, Nykaa, Ola Electric, among others.

US Tariffs Lead To Bloodbath

US Tariffs Lead To Bloodbath US president Trump announced tariffs against over 180 countries on April 2. Apart from country-specific tariffs, he also announced the imposition of a 10% baseline tariff.

In the case of India, Trump announced a 26% tariff. While the tariff on India is lower in comparison to other Asian countries like China, Vietnam, and Bangladesh, it is still higher than what the market expected.

With China announcing retaliatory tariffs against the US, stock markets slumped globally on fears of a trade war.

Consequently, Sensex ended the week 2.6% lower at 75,364.69 and Nifty 50 declined 2.6% to end at 22,904.45.

“Technically, the Nifty has broken below all major price and moving average supports, indicating potential for further downside. The immediate support lies at 22,600, while a decisive breach could open the door towards 22,100. On the upside, any recovery is likely to face stiff resistance in the 23,100-23,400 zone,” said Ajit Mishra, SVP of research at Religare Broking.

The markets will keep a keen eye on the retaliatory measures of other countries against the US in the coming weeks.

“Domestically, while the direct impact of these tariffs is relatively moderate compared to other major economies, it remains more substantial than initially projected. As Q4 earnings season approaches, a sequential improvement in corporate performance is anticipated. However, prevailing weak market sentiment suggests that the phase of consolidation may persist in the near term,” said Vinod Nair, head of research at Geojit Investments.

Besides, the Indian markets will keep an eye on the RBI’s Monetary Policy Committee (MPC) meeting, and IIP and CPI data in the next week.

Now, let’s take a detailed look at the performance of some of the new-age tech stocks this week:

Good Week For ZomatoShares of Zomato gained 4.54% to end the week at INR 210.65. Its market cap also gained $1 Bn from last Friday to end the week at $23.73 Bn.

Here’s what happened at Zomato this week:

- Brokerage firm Goldman Sachs reiterated its “Buy” rating on the foodtech major and assigned a price target (PT) of INR 310. The brokerage said that investors are effectively assigning negligible value to Zomato’s food delivery business and assuming that Blinkit’s EBITDA margins have structurally halved.

- The NCLT by B2B manufacturer Nona Lifestyle over alleged unpaid dues of INR 1.64 Cr on Thursday.

- It was reported that Zomato from its customer support team. The employees were laid off due to performance issues, tardiness, and an overall restructuring effort.

- The foodtech major to eligible employees under its existing employee stock option plans (ESOPs).

Despite multiple new announcements, investor interest in EV major Ola Electric remained subdued this week. The stock ended the week at INR 52.44, down 1% from last week.

Ola Electric’s shares have been on a downward trajectory since the start of 2025 and have declined over 39% year to date.

In an investor presentation this week, Ola Electric claimed that it managed to trim its service turnaround time from 2.5 days in September 2024 to 1.1 days in the months of January and February.

Besides, it also claimed to have grown its auto gross margin from 21% at the end of Q3 FY25 to 24% by the end of Q4.

A day prior to that, Ola Electric’s board approved an Ola Cell Technologies (OCT).

Meanwhile, the company is , a same-day registration and delivery service. Starting with Bengaluru, it plans a pan-India rollout in a phased manner this quarter.

However, it also continues to face regulatory hurdles. As per a report by NDTV Profit, the Maharashtra government has served a notice to Ola Electric to explain why some of its stores in the state are operating without trade certificates.

“It has been found that your company is operating unauthorised showrooms and stores cum service centres and illegally selling vehicles,” the report quoted the government notice as saying.

The post appeared first on .

You may also like

Fury as two Labour MPs denied entry to Israel - 'astounded' and 'unprecedented'

Adam Wharton reveals Thomas Tuchel 'chats' as England boss watches Crystal Palace win

CM Yogi performs 'Kanya Pujan', says 'respecting womanhood is collective responsibility'

Arne Slot shoots down 'weird' Mohamed Salah theory as Liverpool star's disappointment clear

Pamban Bridge brings technology and tradition together: PM Modi